Australian asset manager Monochrome recently announced the application with Cboe Australia to list a Bitcoin exchange-traded fund (ETF) in Q2 2024.

The “strategic move” of its flagship product to Cboe aims to deepen the firm’s reach around the Asia-Pacific region.

A Change of Plans: From ASX To Cboe

In July 2023, the Australian asset manager firm Monochrome re-filed for its Monochrome Bitcoin ETF (IBTC) amid growing interest in the products. Around the same time, its counterparts in the US were submitting their applications to the Securities and Exchange Commission (SEC).

The re-filing came after the Australian Securities and Investments Commission (ASIC) regulatory framework was updated to allow crypto-asset exchange-traded products.

Today, Monochrome announced its “strategic move” to Cboe Australia for its flagship product, IBTC. The Australian arm is one of Cboe Global Markets’ five global listing exchanges.

It’s worth noting that Australia’s application process differs from that of the US. Australian firms should get approval from the national regulator first before applying to be listed on an Exchange.

Monochrome had first planned to list its Bitcoin ETF on the Australian Securities Exchange (ASX). ASX typically holds much higher trading volumes than Cboe Australia in the country.

However, ASX’s process to approve Bitcoin ETF is seemingly longer and more complicated. As reported by local outlets, VanEck has been attempting to bring a spot BTC ETF to ASX since 2021.

Arian Neiron, chief executive and managing director of VanEck Asia-Pacific, said, “approval for an ASX-listed bitcoin ETF is not imminent.” Neiron considers that many regulatory and exchange issues must be addressed “before we see a bitcoin ETF on ASX.”

The Brisbane-based firm commented on its selection of Cboe as their listing venue. Monochrome emphasized “key factors” aligning the exchange and the firm goals. The firm CEO, Jeff Yew, said:

We are proud to work with Cboe Australia to bring Monochrome’s new bitcoin ETF to market, expanding the investment universe for Australian Investors. As leaders in digital assets globally, their established track record and commitment to innovation and safe market accessibility aligns with Monochrome’s strategic objectives.

Bitcoin ETFs To Receive A More Favorable Welcome

Monochrome’s flagship investment product aims to allow “exposure backed by experience.” According to its website, IBTC’s regulated exposure will offer “passive investment” to the flagship cryptocurrency.

The fund will have a “passive buy and hold” approach. This strategy won’t involve trading, derivatives, or short-term price speculation. Moreover, the firm affirms that it works closely with external businesses and technical expert advisors.

If approved, IBTC would be the first of its kind in the country. The fund is proposed for launch in Q2 2024, but the date remains subject to regulatory approvals. Similarly, the fund’s quotation will be conditioned by the market operator and regulatory approval.

The successful launch of Spot Bitcoin ETFs in the US has broadened adoption and interest in crypto-based investment products. Asset management firms are waiting for regulatory institutions worldwide to approve their applications or update their regulatory framework.

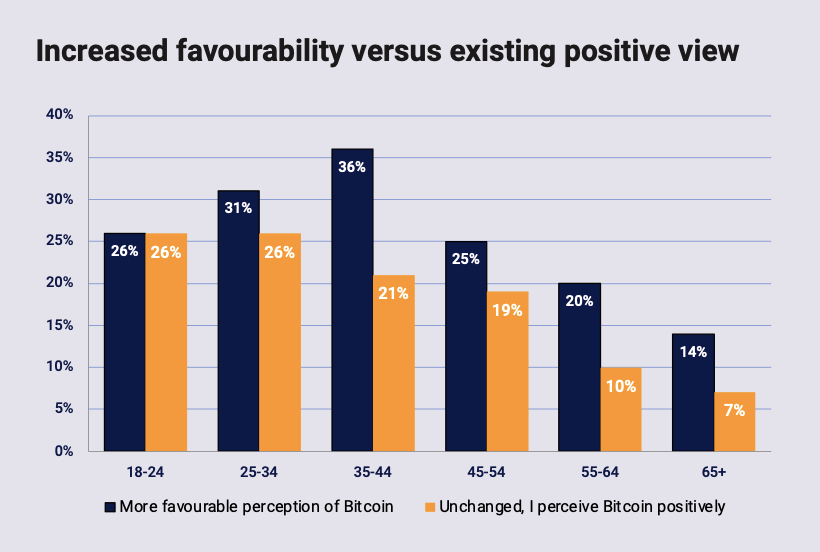

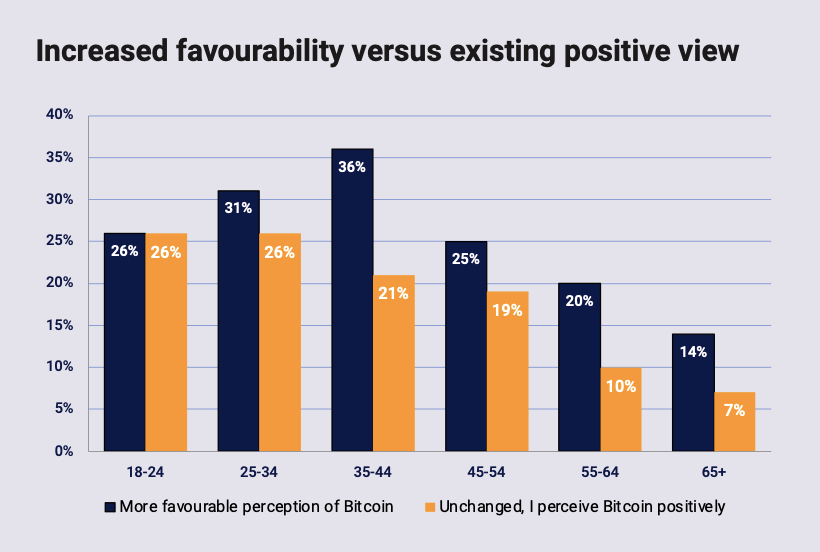

Notably, The Independent Reserve Cryptocurrency Index (IRCI) Australia 2024 revealed that 25% of Australians see Bitcoin more favorably after the approval and success of ETFs in the US. The annual study “examines Australian attitudes towards cryptocurrency, as well as their level of awareness, adoption, trust and confidence in the growing market.”

According to the study, many of the interviewed people had a “more favorable perception of Bitcoin.” The change in perspective includes the older generation, as Australians 55 and older are “warming up” to the flagship cryptocurrency and crypto investments.