As the world of financial markets is growing rapidly, crypto and forex trading are two main avenues for investors planning to grow their wealth. Whichever option you pick, you need to lay down sound strategies to increase your investment success rate. A good starting point is knowing the difference between the two regarding the risk factors, structure, and degrees of volatility. Here is everything you need to know about the two trading realms.

Crypto Trading

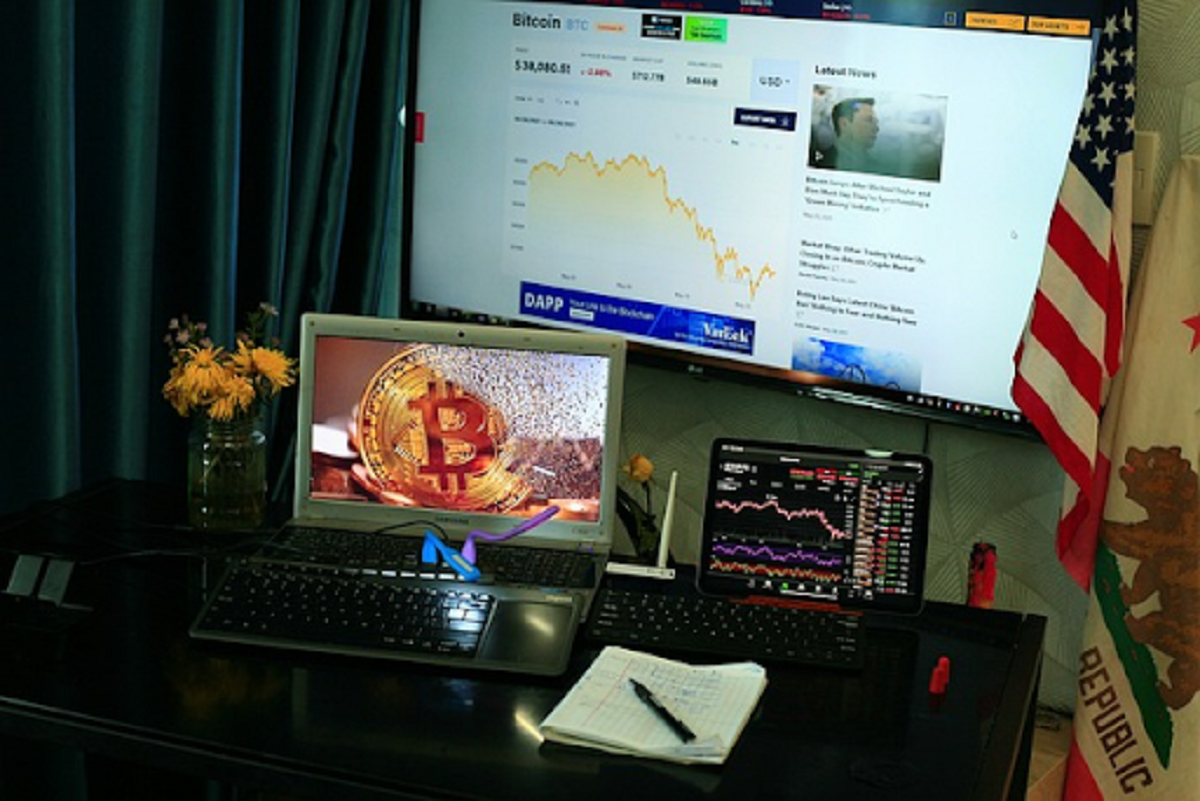

This involves buying and selling of digital currencies, like Bitcoin, Ethereum, and Litecoin, depending on your preferences. Research is critical to identify the specific volatility rates over the trading phases. The good thing with crypto markets is that there aren’t time limits. Any time of the day every week is trading time, which allows you to maximize your profit-making.

Choosing the best crypto exchange is essential for the best experience as you buy bitcoin online. You also want a platform that allows seamless transfer of funds and conversions. For your safety as a user, look at the security measures like encryption and two-factor authentication.

The volatility in the market often presents an excellent opportunity to reap some good profits. Analyze the emerging trends in the market and the performance of each coin regularly. With time, have a way of spreading the risk across different assets to reduce the chances of losses when one crypto fails to perform well.

Forex Trading

Foreign exchange, commonly known as forex, involves buying and selling fiat currencies in the global foreign exchange market. It’s a major attraction to investors, being one of the most liquid and largest markets in the world. Over the years, the daily trading volume has been increasing, and according to the 2022 triennial survey of turnover in the forex markets, it has reached $7.5 trillion.

One significant key benefit of forex trading is the high liquidity it exhibits. It assures you of easy entry and exit positions as a trader. Even when trading large quantities, you can be sure there will be no significant impact on the prices. The market operates 120 hours weekly, translating to 24 hours daily from Monday to Friday. The primary participants are:

- Banks

- Financial institutions

- Corporations

- Individual traders

Several factors, such as geopolitical events and economic indicators, greatly influence the conditions for this market. The central bank can also influence currency prices by increasing or lowering interest rates. It is crucial to also keep a close eye on central bank announcements and adopt the best risk management strategies.

Choosing the Right Path

Before making any decision on whether to go with crypto or forex trading, you have several factors to remember, such as the level of expertise and your risk tolerance. If comfortable with higher risks and volatilities but with higher profit, crypto trading is your best pick. On the other hand, forex trading can be your best choice if you are looking for high liquidity and don’t mind regulation by a central authority.

The decision you make will ultimately come down to your investment goals. Some investors prefer to spread their investments across different markets to leverage the benefits of each. It helps lower the risk of losses, especially when you come up with the best trading strategies and keep studying the market intricacies.

Endnote

Whether you choose forex or crypto trading, you can be sure of lucrative benefits. Before deciding which to go with, concentrate more on your investment targets. Understand how different markets work and how to maximize the profit generation. Always trade responsibly and only invest what you can afford to lose.