The S&P500 trend conditions have reversed into “NoGo” and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds to risk assets. A strong “Go” trend in the volatility index ($VIX), though still hovering around 20 also correlates to the new risk off characteristics on this environment.

The S&P500 trend conditions have reversed into “NoGo” and strengthened to purple bars. Alex Cole and Tyler Wood, CMT identify intermarket forces including rising rates ($TNX) and a strong US Dollar (UUP) that can provide headwinds to risk assets. A strong “Go” trend in the volatility index ($VIX), though still hovering around 20 also correlates to the new risk off characteristics on this environment.

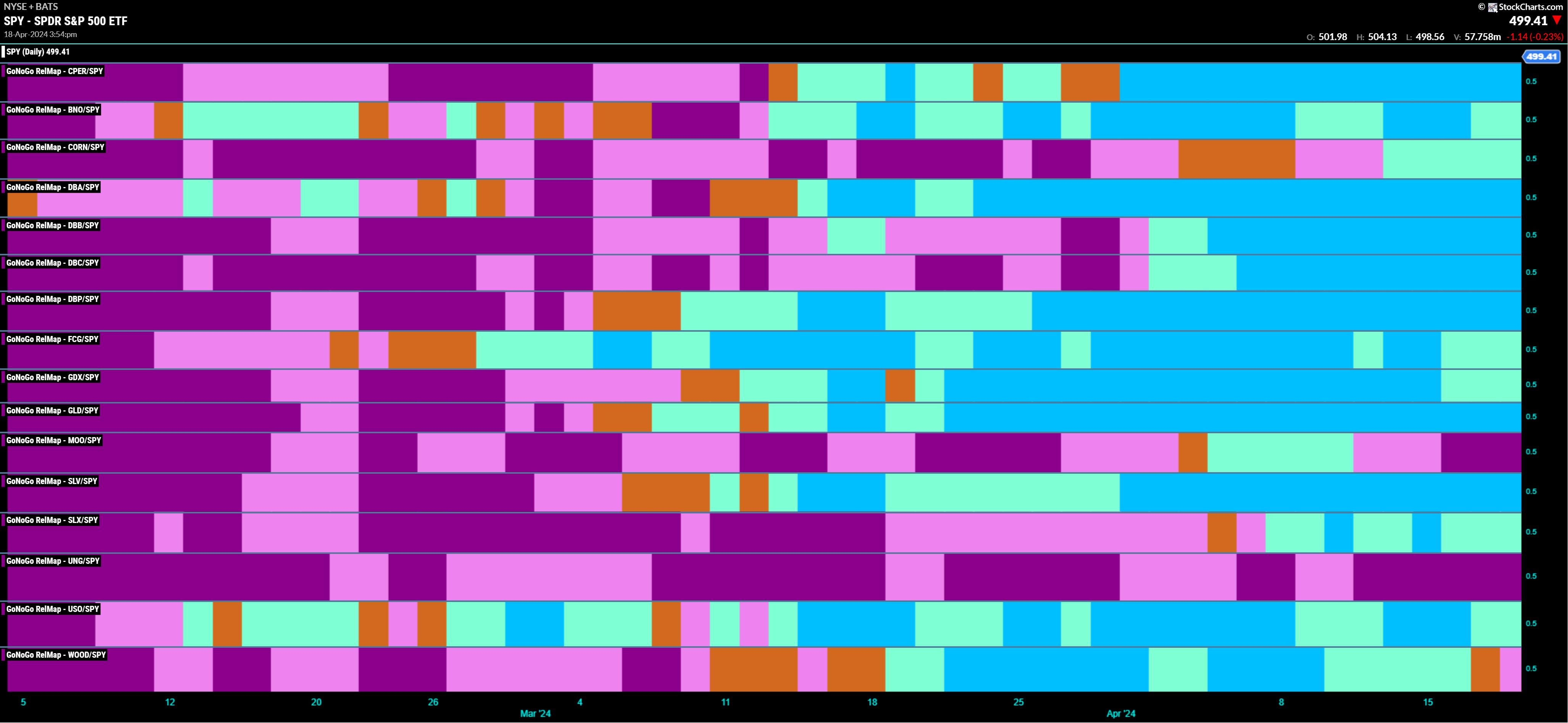

This week we again take a closer look at GoNoGo Trend® conditions across a diverse array of the commodities markets including precious and industrial metals ($GOLD, $COPPER), softs ($COCOA, $COFFEE) and energy ($OIL) all trending in “Go” conditions and outperforming US equities ($SPY) on a relative basis. To express this thesis, Alex and Tyler look at a few equities that stand to benefit from these trends including: Freeport McMoran (FCX), Harmony Mining Inc (HMY) and Marathon Oil (MRO).

The rotation of market leadership into cyclical sectors held up this week as shown in the GoNoGo Sector RelMap®. Energy ($XLE), industrials ($XLI), and materials ($XLB) maintain their trend of outperformance against the S&P 500 index. Interestingly, Communications ($XLC) and Utilities ($XLU) have also joined the leadership group. Alex and Tyler dig deeper into the industry group level within the materials sector (XLB) to see aluminum, non-ferrous metals, and mining groups leading relative outperformance. On an absolute basis, materials have corrected to neutral amber bars as the GoNoGo Oscillator® rests at zero. Finally, Alex and Tyler review a similar risk-off condition in the cryptocurrency space as Bitcoin ($BTCUSD) reverses to “NoGo” trend conditions and what to watch for next in terms of trend continuation and opportunities to enter on pullbacks.

Follow: https://twitter.com/ChartsGonogo

Connect: https://www.linkedin.com/company/gonogo-charts-llc

Learn More: https://www.gonogocharts.com/

Rocks over Stocks | GoNoGo Show April 18, 2024