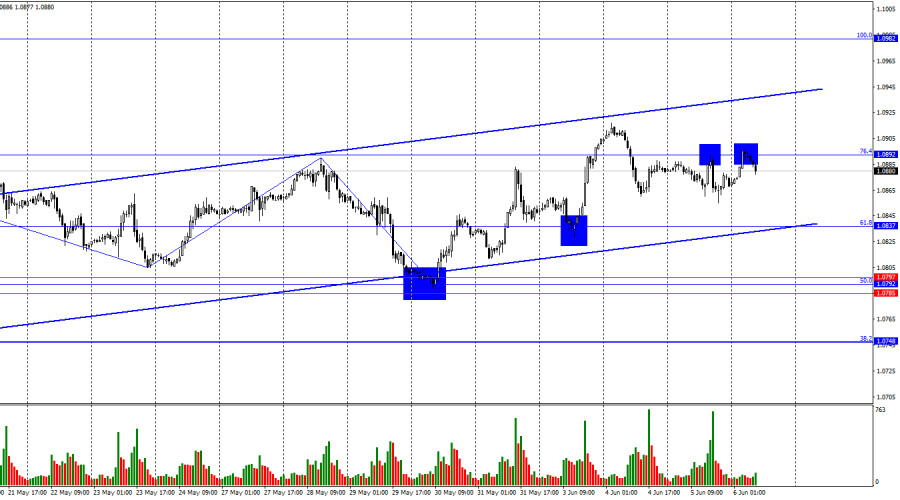

On Wednesday, the EUR/USD pair rebounded from the corrective level of 76.4%–1.0892, a slight decline, and today—a new return to this level and a new rebound. Trader activity yesterday was quite low, but it may sharply increase today. The decline in quotes may continue towards the Fibonacci level of 61.8%–1.0837. Consolidating the pair’s rate below the ascending trend corridor may end the bulls’ dominance.

The wave situation remains clear. The last completed upward wave did not break the peak of the previous wave, and the last downward wave broke the low from May 23, but only by a few pips. Thus, we got the first sign of a trend change from “bullish” to “bearish,” but it soon became clear that we would not see or get any downward reversal. The next upward wave then broke the peaks of the previous two waves. Therefore, for a prolonged decline in the euro, we must now wait for a new sign of a trend change. Such a sign could be close to 1.0785 or below the ascending corridor.

The information background on Wednesday again did not support bear traders as they would have liked. Currently, the European currency is moderately declining, but soon, the results of the ECB meeting will be known, and ECB President Christine Lagarde will speak in half an hour. The rate cut is already priced into the EUR/USD pair, but it is possible that the regulator will not soften monetary policy today. I do not rule out such an option. If rates are not lowered today, then bull traders will again go on the offensive. If Christine Lagarde adheres to “hawkish” rhetoric today, it will also support the euro. And what could be “hawkish” rhetoric? Lagarde may say that the next rate cut will not happen soon and that ensuring the continuation of the inflation decline is necessary.

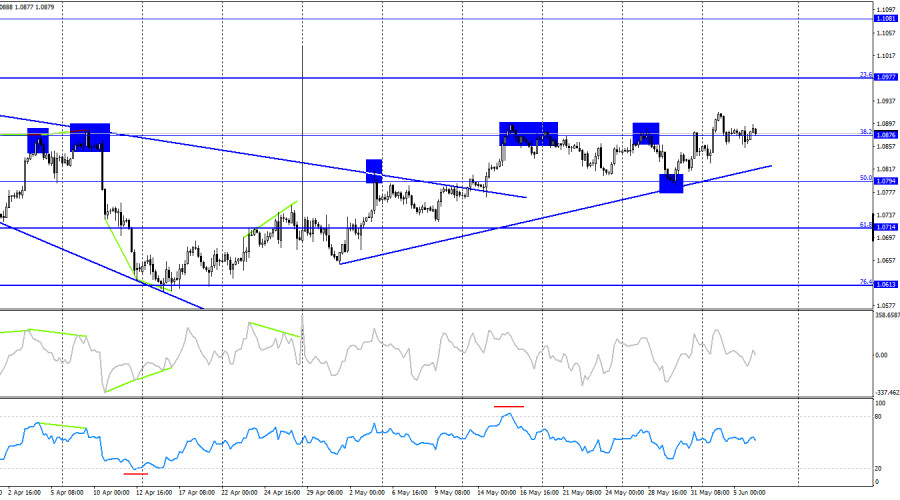

On the 4-hour chart, the pair rebounded from the Fibonacci level of 50.0%–1.0794 and reversed in favor of the European currency. A new “bullish” trend line has formed, so the upward process may continue toward the next corrective level of 23.6%–1.0977. Now, declines in the European currency can be expected after the quotes are consolidated below the trend line. No emerging divergences were observed today for any indicator.

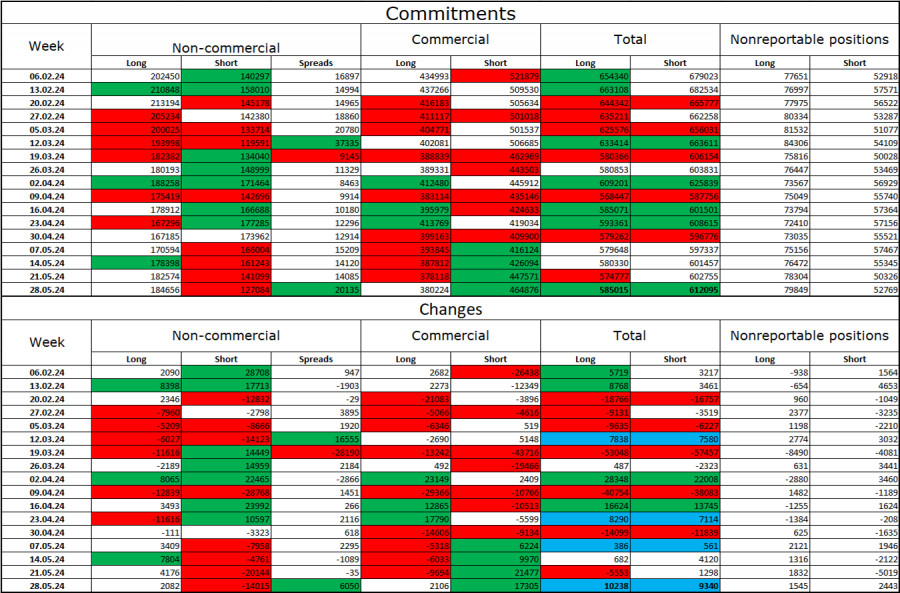

Commitments of Traders (COT) report:

During the last reporting week, speculators opened 2082 Long contracts and closed 14015 Short contracts. The sentiment of the “Non-commercial” group turned “bearish” several weeks ago, but now bulls have the upper hand again, and they are increasing it. The total number of Long contracts held by speculators now stands at 184 thousand, while Short contracts amount to 127 thousand. The gap is widening in favor of the bulls again.

However, the situation will continue to change in favor of bears. I see no long-term reasons to buy the euro, as the ECB is already prepared to start easing monetary policy. This will reduce the yield on bank deposits and government bonds, which will remain at a high level in America, making the dollar more attractive to investors. However, one should now react to the data of graphic analysis and COT report analysis, which speak of a persisting “bullish” sentiment.

News calendar for the US and the EU:

EU – Retail Trade Volume Change (09:00 UTC).

EU – ECB Interest Rate Decision (12:15 UTC).

US – Initial Jobless Claims Change (12:30 UTC).

EU – Christine Lagarde Press Conference (12:45 UTC).

The economic events calendar contains several entries on June 6, among which Christine Lagarde’s speeches and the ECB rate decision stand out. The information background may have a strong impact on traders’ sentiment today.

EUR/USD forecast and trader advice:

Sales of the pair were possible on rebounds from the level of 1.0892 on the hourly chart with a target of 1.0837. These deals can now be kept open. Euro purchases are possible today on a rebound from the level of 1.0837 with targets of 1.0892 and 1.0982. Today, much will depend on the background of the information, so caution should be exercised with any transactions.

The material has been provided by InstaForex Company – www.instaforex.com