Analysis of Trades and Trading Advice on the British Pound

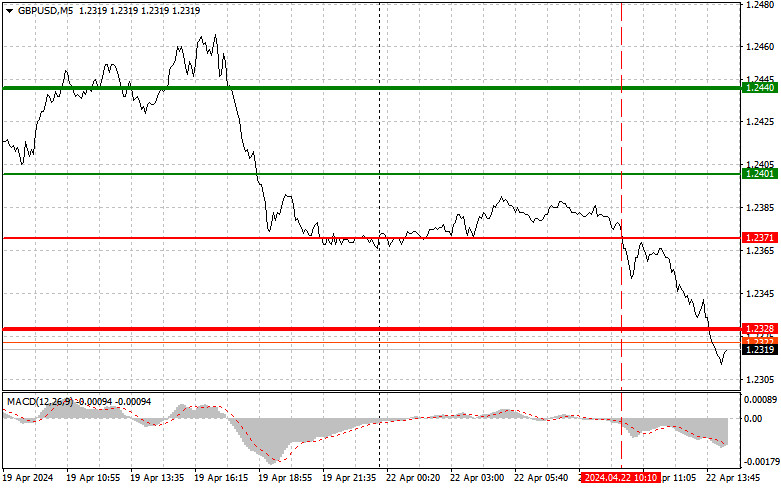

The test of the price at 1.2371 in the first half coincided with the moment when the MACD indicator started moving down from the zero mark, confirming the correct entry point for selling the pound further along the downtrend, which resumed at the end of last week. As a result, the pair fell to 1.2328 – the target support level, allowing them to pull approximately 50 points of profit from the market. News that the UK economy may face serious problems in the second quarter of this year continues to negatively impact pound buyers, discouraging them from entering the market. Unfortunately, there are again no US statistics in the second half of the day and no planned speeches by Fed representatives, which may keep trading within a downtrend with a significant advantage for pound sellers. As for the intraday strategy, I will rely more on scenarios #1 and #2.

Buy Signal

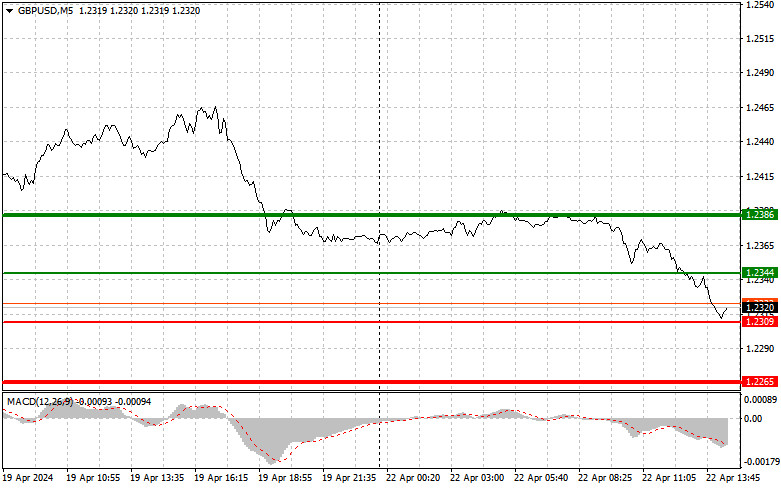

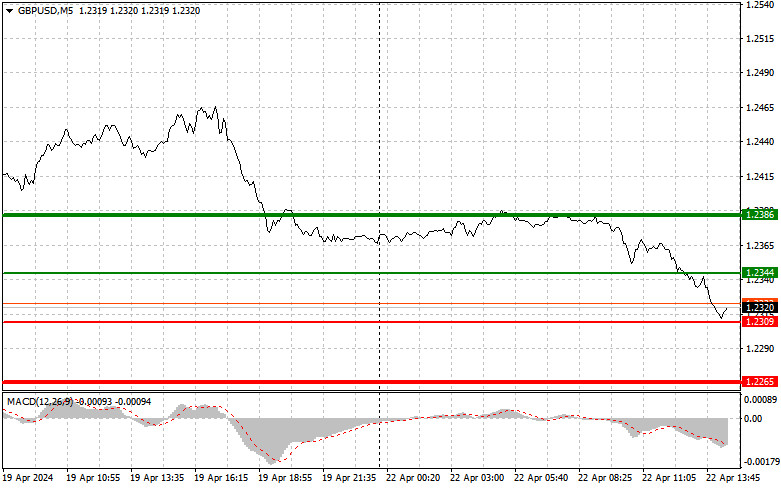

Scenario #1: Today, I plan to buy the pound when the entry point reaches around 1.2344 (green line) with a growth target of 1.2386 (thicker green line on the chart). At 1.2386, I will exit the purchases and open sales in the opposite direction (expecting a movement of 30-35 points in the opposite direction from the level). Today, the pound’s rise can only be expected within an ascending correction after the market finds the bottom. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting its growth from it.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the price at 1.2309, at a moment when the MACD indicator is in the oversold zone. This will limit the downside potential of the pair and lead to a reverse market turnaround upwards. We can expect growth towards the opposite levels of 1.2344 and 1.2386.

Sell Signal

Scenario #1: Today, I plan to sell the pound after updating the level of 1.2309 (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be the level of 1.2265, where I will exit sales and immediately open purchases in the opposite direction (expecting a movement of 20-25 points in the opposite direction from the level). Sellers will show themselves after a slight upward correction if buyer activity is lacking. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the price at 1.2344, at a moment when the MACD indicator is in the overbought zone. This will limit the upside potential of the pair and lead to a reverse market turnaround downwards. We can expect a decline towards the opposite levels of 1.2309 and 1.2265.

On the Chart:

Thin green line – entry price, at which you can buy the trading instrument;

Thick green line – the anticipated price where you can place Take Profit or independently close the profit, as further growth above this level is unlikely;

Thin red line – entry price, at which you can sell the trading instrument;

Thick red line – the anticipated price where you can place Take Profit or independently close the profit, as further decline below this level is unlikely;

MACD indicator. You must guide yourself by the overbought and oversold zones when entering the market.

Important. Beginner traders in the Forex market must be very cautious when deciding to enter the market. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You can quickly lose your deposit without placing stop orders, especially if you do not use money management and trade in large volumes. Remember that for successful trading, you need to have a clear trading plan similar to the one I have presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.

The material has been provided by InstaForex Company – www.instaforex.com