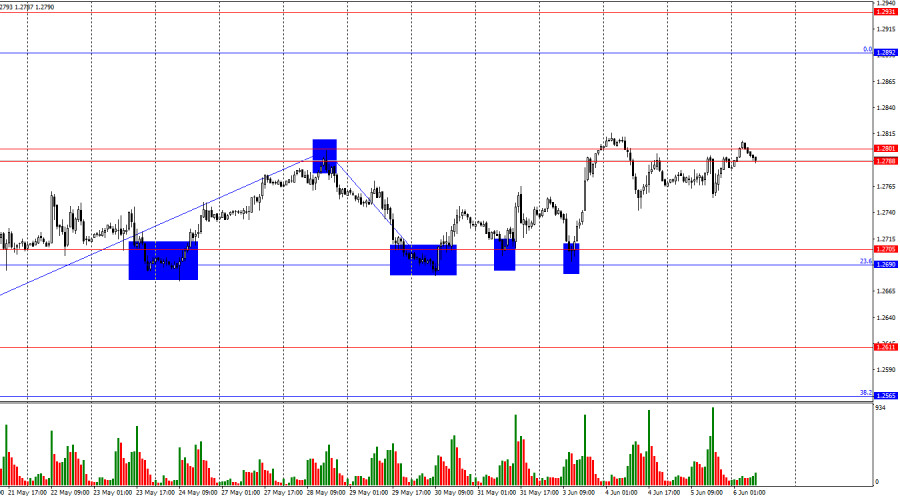

On the hourly chart, the GBP/USD pair returned to the resistance zone of 1.2788–1.2801 yesterday. Another reversal in favor of the dollar may occur around this zone, initiating a downtrend toward the support zone of 1.2690–1.2705. The decline is still very weak as the market awaits new data on the labor market and unemployment, which will be released tomorrow in the second half of the day. If they also turn out to be weak (like many previous reports this week), bulls may attempt to consolidate above the zone of 1.2788–1.2801 once again.

The wave situation remains unchanged. The latest upward wave easily broke the peak from May 3, while the last completed downward wave failed to break the zone of 1.2788–1.2801. Thus, the trend for the GBP/USD pair remains “bullish,” with the bulls holding a significant advantage. The first sign of the end of the “bullish” trend will only appear when a new downward wave breaks the low of the previous wave from May 30. I believe a decline in the British pound should be anticipated, but first, bears must overcome at least the zone of 1.2690–1.2705.

The background information on Wednesday once again did not support the US currency. One US report (ADP) was weaker than traders’ expectations, while another (ISM in the services sector) was stronger. Since these two reports were the most important and were opposite, bears did not gain a significant advantage in the market. The ISM business activity index is much more important than the ADP report. ADP shows the number of jobs created in the non-farm sector. It shows the same thing as Nonfarm Payrolls, which will be released tomorrow. However, traders pay much more attention to payrolls. It is this indicator that the market evaluates the state of the US labor market. Thus, yesterday’s ISM report should have overshadowed the weak ADP, and bears could have attacked more confidently. Today, even the British pound may react to the ECB meeting outcomes.

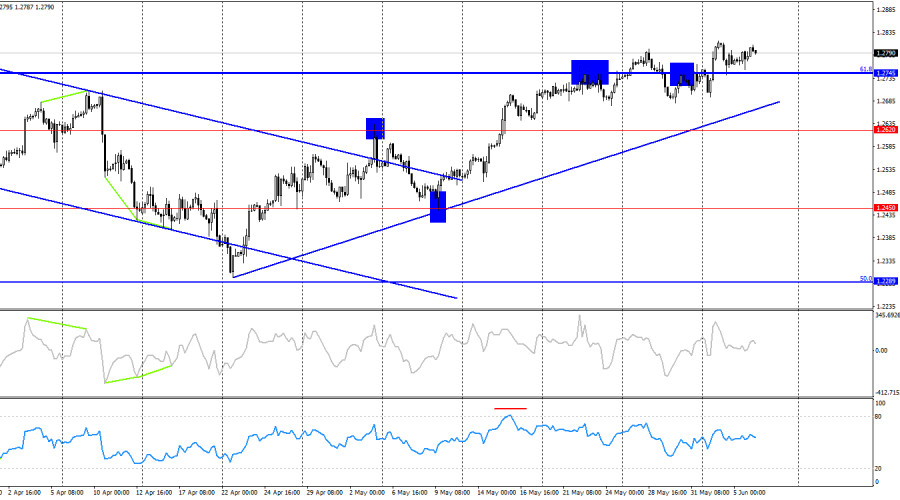

On the 4-hour chart, the pair reversed in favor of the British currency and consolidated above the corrective level of 61.8%—1.2745. Thus, the upward process may continue toward the next level at 1.3044. No emerging divergences were observed today for any indicator. Levels and zones on the hourly chart are currently stronger than on the 4-hour chart. I advise paying more attention to them.

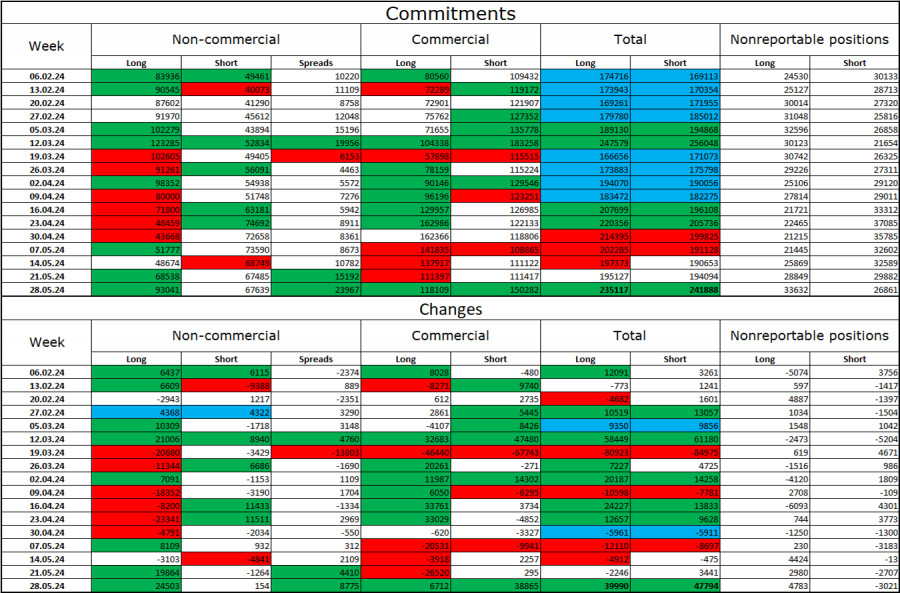

Commitments of Traders (COT) report:

The sentiment of the “Non-commercial” trader category became more “bullish” over the past reporting week. The number of long contracts held by speculators increased by 24503 units, while the number of short contracts increased by 154. The overall sentiment of major players has changed again, and now bulls have a solid advantage. The gap between long and short contracts is 26 thousand: 93 thousand versus 67 thousand. There are still good prospects for a decline in the British pound, but bears are still not ready to advance. Over the past three months, the number of Long contracts has increased from 83 thousand to 93 thousand, and the number of Short contracts has increased from 49 thousand to 67 thousand. Over time, bulls will continue to liquidate Buy positions or increase Sell positions, as all possible factors for buying the British pound have already been worked out. However, the key factor will be the willingness and ability of bears, not the background information or COT report data.

News calendar for the US and the UK:

UK – Construction Business Activity Index (08:30 UTC).

US – Initial Jobless Claims Change (12:30 UTC).

On Thursday, the economic events calendar contains only two entries, which are not the most important for the market. The impact of the information background on market sentiment today may be weak, but there is also the ECB meeting.

GBP/USD forecast and trader advice:

Sales of the British pound are possible on a rebound from the zone of 1.2788–1.2801 with a target of 1.2690–1.2705. Purchases can be opened on a rebound from the zone of 1.2690–1.2705 with a target of 1.2788–1.2801. Or with a new consolidation above the zone of 1.2788–1.2801 with a target of 1.2892.

The material has been provided by InstaForex Company – www.instaforex.com