Trade Analysis on Wednesday:

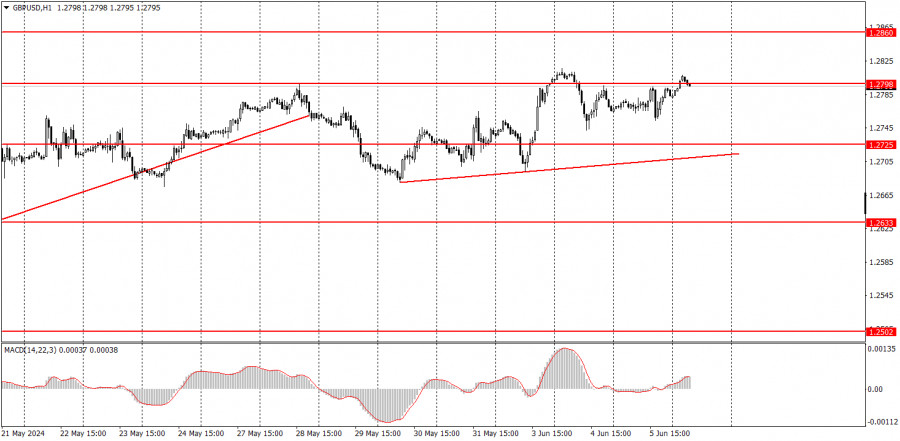

1H Chart of the GBP/USD Pair

The GBP/USD pair also traded with an upward trend on Wednesday. Three reports were published in the UK and the US throughout the day, which could have influenced the pair’s movement. The UK Services PMI did not show a significant value. The US ADP employment report was slightly weaker than forecast, while the important ISM Services Index significantly exceeded expectations. All signs pointed to the US dollar appreciating by at least 50 points. However, that did not happen. We saw a momentary drop of 20-25 points, followed by a resumption of the pair’s growth.

Thus, we can draw the same conclusions as before. The pound sterling rises for any reason, and the market ignores all positive macroeconomic data for the dollar. A third consecutive ascending trend line has formed from a technical perspective, supporting the pair’s growth. Recall that the first two were broken, but no downward movement followed.

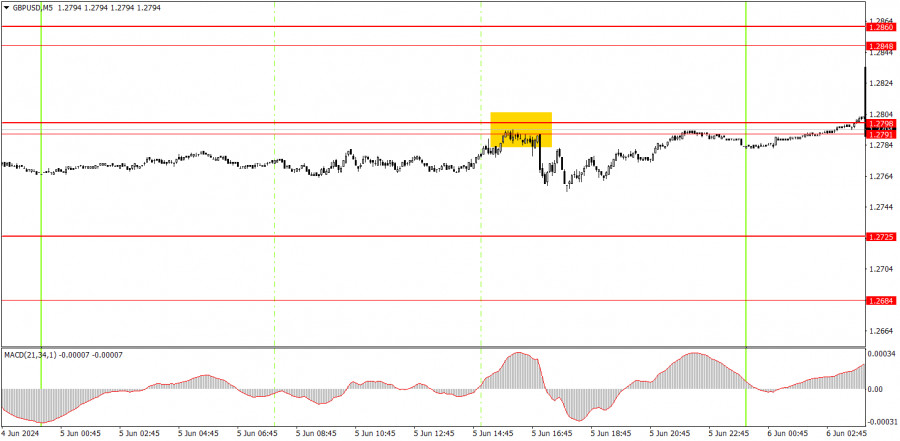

5M Chart of the GBP/USD Pair

On the 5-minute timeframe on Wednesday, only one sell signal was formed near the 1.2791-1.2798 area. After this signal, the price could not move down even 20 points and formed exactly during the publication of the ISM index in the US. The dollar once again refused to appreciate, but novice traders had enough time to close this trade at breakeven.

How to Trade on Thursday:

On the hourly timeframe, the GBP/USD pair still has great potential for forming a downward trend, but the upward correction is still ongoing. We have no questions about movements on days like Monday, although the dollar’s collapse due to one report seems strange. However, we remind novice traders that the dollar does not only fall on days when US macroeconomic data is harmful. A clear example is Wednesday when a strong ISM index did not trigger any growth in the US currency.

On Thursday, the pound sterling may continue to rise, as even this week alone has shown us that the market remains focused on buying. Therefore, overcoming the 1.2791-1.2798 area can be considered a buy signal.

On the 5-minute timeframe, you can now trade at the levels 1.2457, 1.2502, 1.2541-1.2547, 1.2605-1.2633, 1.2684, 1.2725, 1.2791-1.2798, 1.2848-1.2860, 1.2913, and 1.2980. On Thursday, the UK will publish only the Construction PMI, while the US jobless claims report will be released. The pound may also react to the results of the Fed meeting.

Main Trading System Rules:

- The strength of a signal is determined by the time it takes to form (rebound or level breakthrough). The less time it takes, the stronger the signal.

- If two or more trades near any level are opened due to false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can form many false signals or none at all. In any case, stopping trading at the first signs of a flat is better.

- Trading deals are opened between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- In the hourly timeframe, MACD indicator signals should be traded when they have good volatility and a trend line or channel confirms a trend.

- If two levels are very close together (5 to 20 points apart), they should be considered a support or resistance area.

- After moving 20 points in the right direction, a Stop Loss should be set to breakeven.

Chart Elements:

- Support and resistance levels: targets for opening buy or sell trades. Take Profit levels can be placed near them.

- Red lines: channels or trend lines indicating the current trend and the preferred trading direction.

- MACD (14,22,3) indicator: histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can significantly impact a currency pair’s movement. Therefore, during their release, it is recommended to trade with maximum caution or exit the market to avoid a sharp price reversal against the preceding movement.

Beginners trading in the forex market should remember that only some trades will be profitable. Developing a clear strategy and money management are the keys to success in trading over the long term.

The material has been provided by InstaForex Company – www.instaforex.com

Moonshot Investments: Top Crypto Picks for 2024

Moonshot Investments: Top Crypto Picks for 2024