As the anticipated Bitcoin Halving approaches, a new native digital commodity protocol is set to make its presence felt in the cryptocurrency landscape. The Runes Protocol, developed by the mind behind the Ordinal Theory, Casey Rodarmor, is generating buzz as it introduces a new fungible token standard for Bitcoin.

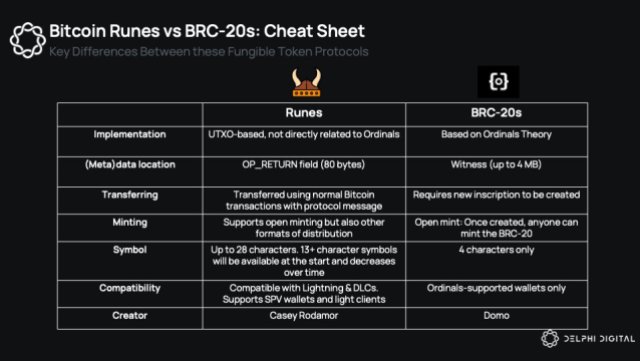

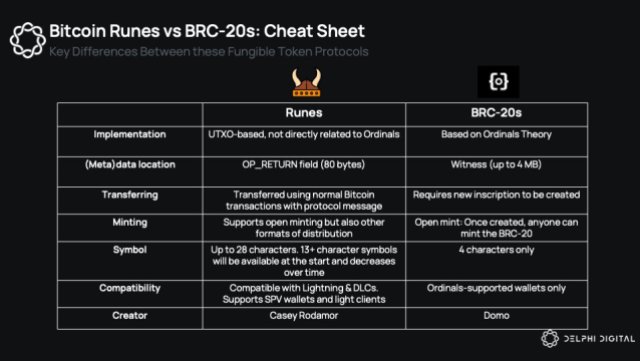

A recent report by crypto analysis firm Delphi Digital sheds light on the potential of Runes to disrupt the tokenization landscape, challenging the dominance of BRC-20s.

A Glimpse Into The Runes Protocol

Unlike its predecessors, Runes is not a token itself but rather a framework that enables the creation of altcoins on the Bitcoin Network. Tokens created using the Runes Protocol, aptly named “Runes,” are fungible, meaning each Rune is interchangeable.

According to the research firm, this token standard offers several unique features that set it apart from existing token standards.

The Runes Protocol leverages Bitcoin’s UTXOs (Unspent Transaction Outputs) to store balances of both Bitcoin and Runes. This approach allows users to create and trade Runes instantly within the Bitcoin ecosystem.

The Runes Protocol aims to increase transparency and security by moving trust from the indexer level back to the Bitcoin blockchain.

Notably, the Runes ecosystem incorporates a unique mechanism for fair launches. The first Rune, called UNCOMMON•GOODS (Rune 0), is open for minting from the upcoming Halving to the next of these events.

Additionally, token names in the Runes ecosystem must initially have 13 or more characters, with the character count requirement gradually decreasing until all names become available for use.

Battle Of Token Standards

BRC-20s, with a market size exceeding $1.5 billion, have dominated the tokenization landscape. However, the emergence of Runes has sparked speculation about its potential to supersede BRC-20s. Delphi Digital’s report highlights key differences between the two token standards, with Runes offering potential advantages.

Runes streamline token creation by utilizing the OP_RETURN field, simplifying the process compared to BRC-20s, which require new inscriptions for every token transfer.

According to Delphi Digital, Runes also provides greater flexibility in token creation, supporting features such as open mint, fair distribution, and single address minting.

Additionally, Runes is more compatible with simplified payment verification (SPV) wallets and Bitcoin Layer 2 (L2) solutions, enabling faster and cheaper transactions.

Potential BRC-20 Upgrades

While the Runes protocol offers significant benefits, it has limitations. The report points out that the current state of infrastructure development presents challenges in realizing the full potential of Runes compatibility.

In addition, introducing the Cenotaph model to allow for protocol upgrades raises concerns about the potential loss of runes due to “malformed runestones.”

As the Runes Protocol gains traction, rumors have surfaced about potential updates to the BRC-20 standard, including the ability for BRC-20 indexers to compute Ethereum Virtual Machine (EVM) smart contract code.

Delphi Digital notes that this development could address some of the design issues faced by the BRC-20, thereby increasing competition between the two token standards.

Overall, with the imminent launch of the Runes Protocol, the crypto community eagerly awaits the potential disruption it may bring to the tokenization landscape.

Delphi Digital’s report underscores Runes’ unique attributes and advantages, positioning it as a formidable contender to challenge the dominance of BRC-20s.

Ordinals (ORDI), the leading BRC-20 token in the cryptocurrency market, is currently trading at $45.58. However, its value has significantly declined by over 32% over the past month.

Featured image from Shutterstock, chart from TradingView.com