Analysis of Macroeconomic Reports:

There are a few macroeconomic events scheduled for Thursday. In the Eurozone, a more or less significant report on retail sales will be published. In the UK, a secondary report on the Construction PMI will be published. In the US, a secondary report on jobless claims will be published. These reports are unlikely to provoke a market reaction of more than 10-20 points. The main focus today will be on Christine Lagarde’s speech.

Analysis of Fundamental Events:

Of the fundamental events on Thursday, we highlight the ECB meeting. However, there are practically no questions about the meeting itself and its results—it is well-known that with a high degree of probability, the European regulator will cut the key interest rate today. This has been known for several months. The real intrigue lies in ECB President Christine Lagarde’s speech. Ms. Lagarde could make statements that might disappoint the market, which is currently focused only on buying euros. Conversely, she could also temper the enthusiasm of traders who buy euros under any circumstances. Therefore, today’s key event is not the ECB meeting and its rate decision but Christine Lagarde’s speech.

General Conclusions:

On the fourth trading day, you should focus on the ECB rate decision, the ECB’s final communique, and Christine Lagarde’s press conference. These events could trigger either a fall or another rise in the euro or even impact the pound sterling, though this does not always happen. However, both European currencies are still aimed at growth, so they could use any factor to appreciate more.

Main Trading System Rules:

- The strength of a signal is determined by the time it takes to form (rebound or level breakthrough). The less time it takes, the stronger the signal.

- If two or more trades near any level are opened due to false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can form many false signals or none at all. In any case, stopping trading at the first signs of a flat is better.

- Trading deals are opened between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly timeframe, MACD indicator signals should be traded when they have good volatility and a trend confirmed by a trend line or trend channel.

- If two levels are very close together (5 to 20 points apart), they should be considered a support or resistance area.

- A Stop Loss should be set to breakeven after moving 15-20 points in the right direction.

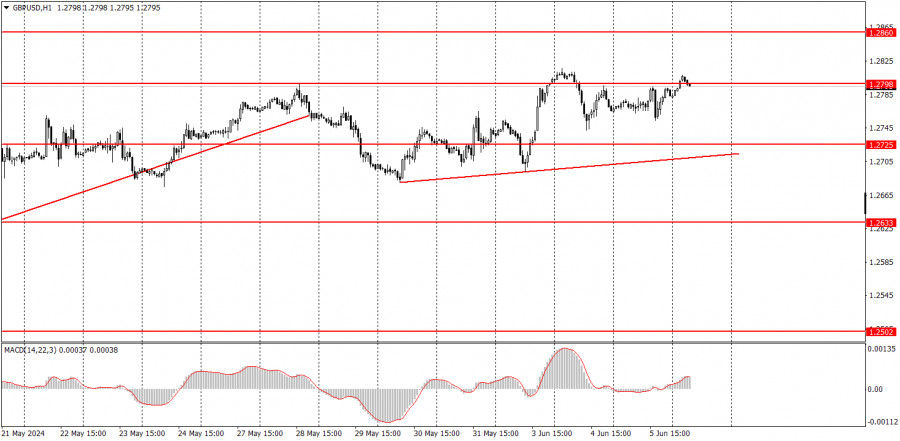

What’s on the Charts:

- Support and resistance levels: targets for opening buy or sell trades. Take Profit levels can be placed near them.

- Red lines: channels or trend lines indicating the current trend and the preferred trading direction.

- MACD (14,22,3) indicator: histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can significantly impact a currency pair’s movement. Therefore, during their release, it is recommended to trade with maximum caution or exit the market to avoid a sharp price reversal against the preceding movement.

Beginners trading in the forex market should remember that only some trades will be profitable. Developing a clear strategy and money management are the keys to success in trading over the long term.

The material has been provided by InstaForex Company – www.instaforex.com