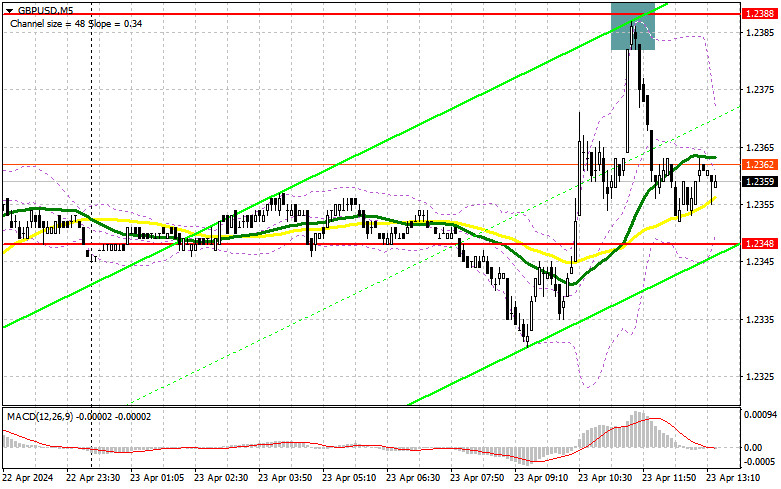

In my morning forecast, I paid attention to the 1.2388 level and planned to make decisions on entering the market from it. Let’s look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown in the area of 1.2388 led to a sell signal for the pound, which resulted in a drop in the pair by more than 30 points. In the afternoon, the technical picture was revised.

To open long positions on GBP/USD, it is required:

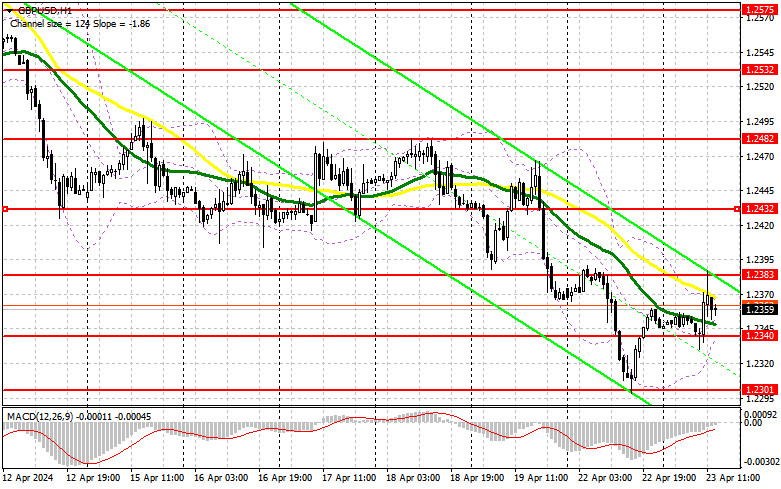

The strong data on activity in the UK services sector and the weak report on the reduction in manufacturing activity were received positively, since the British economy is still based more on services. This provoked purchases of the pound, but the euphoria did not last long. The growth was perceived by sellers as an excellent entry point into short positions. In the afternoon, there is a lot of data related to activity in the American economy, so there should be movement. The index of business activity in the manufacturing sector, the index of business activity in the service sector and the composite PMI index will be the warm-up, after which figures on home sales in the primary market and the Fed-Richmond manufacturing index will be released. Strong data will lead to a larger sell-off of the pound on trend, so be careful with purchases. In the case of a decline in the pair, much will depend on the behavior of traders at the level of 1.2340, where only the formation of a false breakdown will give an entry point to buy in order to grow to the resistance of 1.2383 formed at the end of the first half of the day. A breakout and a top-down test of this range will return the chance of a GBP/USD recovery, which will lead to new purchases and allow you to get to 1.2432. In the case of an exit above this range, we can talk about a breakthrough to 1.2482, where I’m going to fix profits. In the scenario of a fall in GBP/USD and the absence of buyers at 1.2340 in the afternoon, sellers will regain control of the market, having the opportunity to continue a major drop in the pair further along the trend. In this case, I will look for purchases in the area of 1.2301. The formation of a false breakdown there will be a suitable option for entering the market. It is possible to open long positions on GBP/USD immediately on a rebound from 1.2265 in order to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears have every chance to continue the pair’s decline. To do this, you need to protect the new resistance of 1.2383, where the moving averages are located slightly lower, playing on their side. The formation of a false breakdown there will make sure that large sellers are present in the market, which, together with strong data, will lead to a further fall in GBP/USD and an excellent entry point into short positions in order to test the nearest resistance of 1.2340. A breakout and a reverse test from the bottom up of this range will increase the pressure on the pair, giving the bears an advantage and another entry point to sell with the aim of updating 1.2301. The ultimate target will be a minimum of 1.2265, where I will take a profit. In the event of GBP/USD’s rise and absence of bears at 1.2383 in the second half of the day, bulls will have the opportunity to build a good correction with upward movement towards the resistance at 1.2432. I will also sell there only on a false breakout. If there is no activity there either, I suggest opening short positions on GBP/USD from 1.2482, counting on a pair’s rebound downwards by 30-35 points within the day.

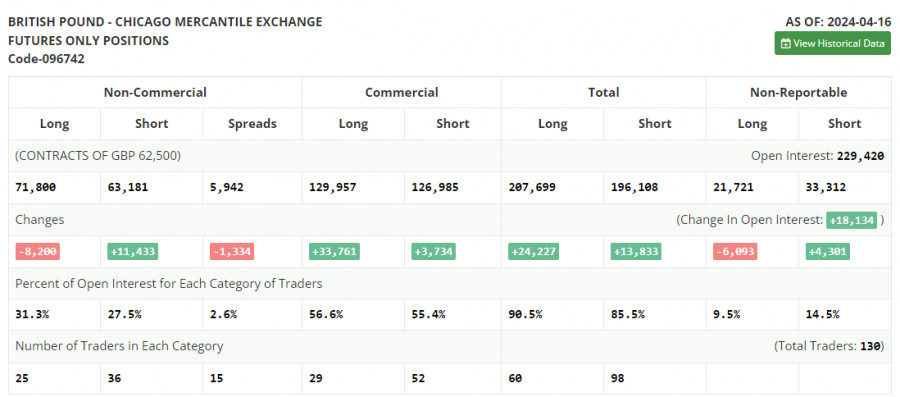

In the COT report (Commitment of Traders) for April 16th, there was a sharp reduction in long positions and an increase in short positions. Pound buyers continue to leave the market, and there are objective reasons for this: the released data on inflation in the UK and the US indicated the need for further efforts to combat price increases, which will surely force central banks to continue to adhere to a tough stance. Given that the UK economy suffers from all this much more than the US economy, it is not surprising why pressure on the British pound has sharply increased. New statements from regulator representatives also negatively affected the bullish prospects for the pound. Add to all this the need to maintain a tough stance by the Federal Reserve, and it is unlikely that a strong bullish market in the GBP/USD pair should be expected. The latest COT report states that long non-commercial positions decreased by 8,200 to 71,800, while short non-commercial positions increased by 11,433 to 63,181. As a result, the spread between long and short positions decreased by 1,334.

Indicator signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating a bearish market.

Note: The period and prices of moving averages considered by the author are on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2340, will act as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders – speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The net non-commercial position is the difference between the short and long positions of non-commercial traders.

The material has been provided by InstaForex Company – www.instaforex.com